Why is money printing bad? Think of a poker game, 5 players at the table, each put in $20 for 20 chips. So there is a $100 actually backing up 100 chips. The players play all night, drink, tell tales, it’s been a fun night. 11:30 PM comes around, time to wrap it up and cash out.

Wait, there are 120 chips on the table. WTF?!?!?! Somebody is not playing fair. Somebody cheated and brought in their own chips. Accusations fly you did it! NO! You DID IT! Nobody admits to it so now $100 must be divided amongst 120 chips with each chip being worth 80 cents now instead of a dollar.

Everyone except for the cheater is disappointed because he got to play on, play longer when he probably should have been forced out of the game or alter his behavior to stay in the game.

This parallel should taught to ALL high school seniors but it is not.

The scenario I just described is almost exactly what the United States Treasury and the US Federal Reserve have been doing since 2008 though their bond sales.

WHY DOES THE US TREASURY SELL BONDS?

At the time I was working in the market, the US Treasury brought in $2.2 Billion in taxes, fees and revenues. However the US Government was spending $3.3 Billion a year, leaving a$ 1.1 Billion short fall. Thus the Treasury sells bonds to make up the difference.

If the Government were to raise taxes in order to make up the $1.1 Billion difference there would probably be a revolution in this country or at least the elected officials would be thrown out of office. Politicians like their jobs so it is far LESS PAINFUL to borrow.

Unbeknownst to most Americans, the US treasury had its very first and only FAILED BOND AUCTION. What is a failed auction? The US Treasury Department, in order to fund current US Government obligations holds regular auctions (sales) of its Treasury Bills, Notes and Bonds. This is where big banks loan money to the US Federal Government for 1 year, 10 years or 30 years. The treasury has a particular number of these items that must be unloaded to the banks and one time in 2008 they did not all sell. This was UNPRECEDENTED in US history.

This was considered to be a catastrophic event, especially since this was right around the time of Lehman Brothers Investment Bank declaring bankruptcy. Investment banks and insurance companies were deeply in debt to each other as well as the investing public and money was drying up. FAST. The US Government worried it could NOT PAY ITS OWN BILLS.

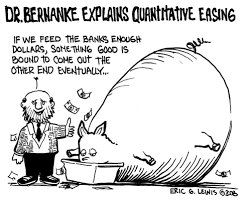

Enter the US Federal Reserve. The only bank in the world that cannot be audited. No one knows how much money they really have, they just say they have it. They do not physically transport truckloads of dollar bills or gold or silver to the banks. They simply transfer electronic numbers from one column to another and voila, the banks have more money.

Now the official theory of Quantitative Easing ” is a monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3][4] A central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the money supply.”

In other words, Banks are sitting on these old bonds for the past 5-29 years. “Hey lets buy those bonds from the banks and give them their money back so more money can get into the system and banks can make loans.” Wrong, WRONG, WRONG!!!!

***** THIS IS THE GIST RIGHT HERE

The banks are now (Under Quantitative Easing, QE1 QE2 or QE3) buying bonds from the US Treasury Department, ( remember the US Government needs money to operate) and within seconds, the US Federal Reserve is buying them from the banks.

HOW DOES THIS BENEFIT THE BANKS?

The banks buy the bonds for one price and sell them to the US Federal Reserve or the FED at a slightly higher price. This is called the “Spread” on bonds. But more importantly without QE, government could not fund itself. Remember all those free handouts to the poor? All that foreign aid we hand over to other countries to buy influence. Keeping the populace content with food and basic necessities prevents insurrections and civil war. For a time anyway.

WHY DO THE BANKS ACT AS A MIDDLEMAN BETWEEN THE FED AND THE US TREASURY?

It is unlawful for the US Federal Reserve to directly fund the Treasury Department. There is also NO MINIMUM time that the banks must hold these bonds they just bought from the US Treasury. So it is only a matter of SECONDS that the Banks actually hold on to the bonds before the FED buys them from the banks.

What do they buy the bonds with??? Remember that FICTIONAL ELECTRONIC MONEY that the Fed transfers over to the banks? That is what they pay with. Therefore the money that the US Federal Government is receiving from the banks is also FICTIONAL ELECTRONIC MONEY. So when the FED or the US Treasury tells you “We are NOT printing money”, technically they are not lying. There is no longer the need to keep the printing presses going to create paper money it’s all electronic and fake. Only the citizens belief that it has value, keeps it valuable.

Jack Johnson Esq.